Understanding, and acting on, the issues that are most material to your organisation and stakeholders is fundamental in all areas of business.

Applying this to ESG is no exception. It’s certainly the approach that institutional investors take when assessing the ESG plans and performance of future and existing assets.

In addition, it is now a mandatory requirement for companies that meet the criteria to comply with the newly adopted EU Corporate Sustainability Reporting Directive (CSRD).

Welcome to double materiality.

So, what is double materiality?

In a nutshell, double materiality is an exercise that captures and prioritises your company’s environmental, social and governance related impacts, risks and opportunities. Ultimately, it identifies where you should focus your resources.

The ‘double’ part of the name references two perspectives:

- Impact materiality: the positive and negative impacts a company’s activities have, or could have, on the environment and society e.g., the greenhouse gas emissions a company produces.

- Financial materiality: ESG-related topics that affect a company’s main stakeholders and therefore impact the bottom line e.g., the ability to attract top talent through an engaging company culture.

Why is it important?

- It provides clear direction for your company's strategy and drives value

Conducting a double materiality assessment answers the question, “where do I start with ESG?” by providing clarity on the priority environmental, social and governance areas that are most material i.e., most important for your business to focus on. Ultimately, driving value for your business now and in the future by focusing your strategy on the ESG-related issues that influence stakeholders’ decisions and ensuring your business will continue to thrive in a context of rapidly changing environmental and societal dynamics. - It is expected by your investors

Investors now expect companies to undertake a double materiality assessment to identify and address their material ESG priorities.

“Looking at material risks from both a financial and wider sustainability perspective is becoming standard practice for investors and companies”.

Head of EMEA equity research and co-head of global ESG research at JP Morgan - Double materiality is mandatory in the EU for large and listed companiesConducting a double materiality assessment is a key requirement of the Corporate Sustainability Reporting Directive (CSRD). For now, this only applies to large EU companies, those listed in the EU and non-EU businesses with a high turnover from the EU, but the number of companies covered by this directive will broaden over the next few years.

Five steps to undertaking a double materiality assessment

Task 1: Assess the environmental and social impact of your company’s activities.

Step 1: Identify the impacts your business has on the environment and on society:

- Map out your business’ value chain and identify where your organisation has positive and negative impacts on the environment and on society. As well as looking at actual areas of impact, identify risks (i.e. potential negative impacts) and opportunities (i.e. potential positive impacts). See examples below:

- Actual negative impact from greenhouse gas emissions

- Actual positive impact on employees by providing training and development opportunities.

- Risk of human rights issues in a complex supply chain.

- Opportunity to make your product/service accessible to a group who would not be able to afford the product/service at market rates

- Cross-check the list of impacts, risks and opportunities against ESG standards e.g. Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI) and the material topics identified by peers to ensure the list of impacts is comprehensive and you haven’t missed anything critical out.

Step 2: Identify the severity of each impact and rank them accordingly.

- Identify the severity of each positive and negative impact, risk and opportunity by considering:

- i) the scale of the impact i.e. the extent of the positive or negative impact the company has or could have,

- ii) how widespread an effect does/could the company have on the identified impact,

- iii) the irremediable character of the impact i.e. how hard it is to counteract or make good the resulting harm. Rank the impacts according to the relative severity.

- This exercise should be based on data where possible but it will inevitably require an element of judgement based on collective knowledge of the business’ operations.

Step 3: Summarise the prioritised impacts.

- Consolidate the identified positive/negative impacts, risks and opportunities into around 10-15 ESG-related topic areas e.g. greenhouse gas emissions, diversity and inclusion, employee development. Create statements that clearly articulate the topic areas so you can describe these areas to your key stakeholder groups who you will be speaking to in the next stage. See examples below:

- Becoming a net carbon business

- Promoting diversity and inclusion

- Developing the skills of our people

Task 2: Assess which topics your stakeholders consider important for your business.

Step 4: Engage with your key stakeholder groups to find out what is important to them.

- Identify the stakeholder groups that are most important for your organisation e.g. clients, employees, investors.

- Engage with these groups to understand which of the 10-15 identified ESG-related topic areas are most important to them and therefore are the most material to the commercial success of your business. In an ideal world, this engagement should be done in a consistent manner across all groups so you can compare data e.g., through a survey that goes out to employees, clients, investors, suppliers etc. However, the method of engagement may need to flex depending on the nature of the stakeholder groups.

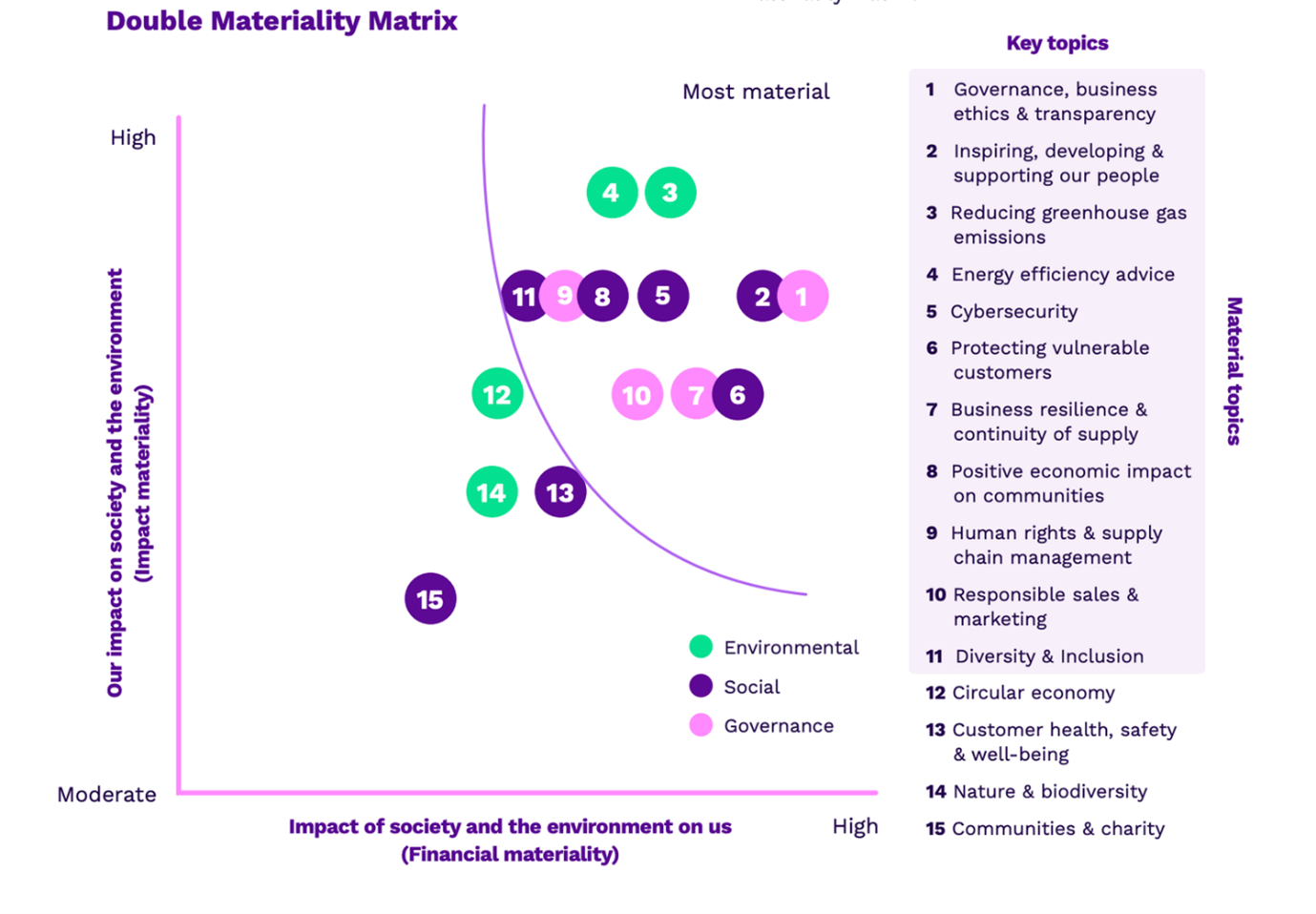

Step 5: Summarise the data in a materiality matrix.

- Plot the impact materiality (i.e. the severity measure for each topic) on the y-axis and the financial materiality (i.e. the results of the stakeholder groups surveys) on the x-axis to identify the top 8-10 ESG-related topic areas for your business to focus on.

Example of a materiality matrix (Telecom Plus PLC ESG Report 2023).

The more you can base your materiality assessment on evidence and data, the better. However, when this isn’t feasible, use your best judgement and be transparent with how you have approached the exercise… don't let perfect be the enemy of good!

We have helped many organisations, from SMEs to FTSE listed companies, with carrying out double materiality assessments. If you would like to discuss how we could help you, or if you just want an informal chat about how to get started, please do get in touch.

This blog was written by Claire Kennedy from Thrive. Click here to read more on our partnership.

Related News, Insights & Events

Failure to prevent fraud: Reasonable procedures guidance published

The UK Government has published long-awaited guidance on reasonable procedures to prevent fraud.

What you need to know about climate-related group claims in Scotland

Climate-related claims are a growing risk for corporates around the world.

Burness Paull supports SCOTLAND: The Big Picture as Rewilding Business Partner

09/10/2024

Burness Paull announces new partnership with rewilding charity, SCOTLAND: The Big Picture.