As a trainee solicitor in the tax team at Burness Paull, this has been my first experience of a Scottish budget from a tax law perspective, and I was keen to hear the views of my colleagues on the decisions taken.

The budget did not produce many significant tax changes; however I have set out a summary of the key changes below, alongside a selection of the comments from members of the tax team, providing their insight.

Land and Building Transaction Tax

One of the main changes from the Scottish budget (although not well reported on by BBC and other media) was the increase to the Additional Dwelling Supplement rate, from 6% to 8%. At the time of writing the increase is in effect, beginning on 5 December 2024. Transactions for which missives had been entered on or before 4 December will not be affected by the announcement.

There were no further changes to Land and Building Transaction Tax, however a significant number of consultations and reviews were announced, commencing in early 2025. This will include reviews of aspects of the current residential and non-residential regime, which some people consider may see the removal of the Multiple Dwellings Relief, following the removal of the equivalent relief in England earlier this year. The consultation will also assess Co-Ownership Authorised Contractual Schemes (CoACS) and Property Authorised Investment Funds (PAIFS).

Nicola Williams (Partner, Tax and Share Incentives) commented: “Given the increase in the equivalent SDLT charge for second homes (from 3% to 5%) in the October budget, it was inevitable the Scottish government would use this opportunity to increase the additional dwellings rate for LBTT (from 6% to 8%) – allowing LBTT to remain the clear leader in the extra charge on second homes and buy-to-lets.”

Income tax and council tax

For the individual taxpayer the most interesting announcement may have been the proposed 3.5% increase to both the basic and intermediate rate bands for income tax. In 2024-2025 the basic rate band was £14,877 to £26,561 whereas in 2025-2026 it will be £15,398 to £27,491; the intermediate band was £26,562 to £43,662 but will rise to £27,492 to £43,662 in 2025-2026. These bands will further benefit from a continued rise by at least the rate of inflation for the rest of this Parliament. The remaining bands will be maintained at their current levels and no new bands will be introduced.

The freeze on council tax has been lifted, with the Scottish Government urging councils to not increase rates although they now have the right to do so. This will be an interesting one to watch.

Christine Yuill (Partner, Tax and Share Incentives) noted that: “Although a rise to the income tax thresholds will be welcomed, and a tax-payer in each of these bands will pay less tax than elsewhere in the UK, it is usually only around £20 less. However, those in the higher bands continue to pay significantly more tax than their counterparts in the rest of the UK.”

Business rates

The budget includes a freeze on the non-domestic rates Basic Property Rate for premises valued at less than £51,000. This will see rates frozen at 49.8%. In addition, a 40% relief will be introduced for properties in the hospitality sector, rising to a 100% relief for hospitality in the Highlands and Islands. This relief is capped at £110,000 per business.

Charlie Fletcher, (Solicitor, Tax and Share Incentives) said: “These targeted reliefs for the hospitality sector should offer some respite to businesses, however these reliefs exclude other sectors such as leisure, and notably retail, which benefits from the equivalent relief in England”.

Scotland’s Tax Strategy

The Scottish Government also published Scotland's Tax Strategy which sets out their approach to develop a tax system which provides support, stability, and efficiency. The Strategy works towards a tax system which raises the revenue required to achieve government priorities and support Scotland's economy.

My view on this is: “I have heard that this is an interesting development given the Scottish Government has not released a strategy for tax before, and it does not appear common across other jurisdictions. It will be interesting to see how the tax strategy and tax legislation develops over the remainder of this government and any future government”.

Key Contacts:

Nicole Melville

Trainee Solicitor

Nicole is a trainee solicitor at Burness Paull.

Nicola Williams

Partner

Tax & Share Incentives

Nicola is also qualified in New Zealand and her areas of expertise include M&A, share schemes and private equity and angel investment.

Related News, Insights & Events

The Scottish Budget 2024: Our views on the tax changes

The budget did not produce many significant tax changes; however I have set out a summary of the key changes below.

Burness Paull advises management team of Horizon Energy Infrastructure and Smart Meter Assets on merger and ownership transfer

04/12/2024

Burness Paull advised Horizon Energy Infrastructure and Smart Meter Assets on their merger with Smart Metering Systems and ownership transfer to KKR.

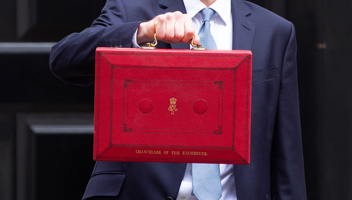

Chancellor announces biggest tax rise in over 30 years

Rachel Reeves yesterday announced the government’s long anticipated Autumn 2024 Budget.