Tax and Share Incentives can be a high-risk area. Getting it wrong can be expensive.

Tax is increasingly a reputational issue and important to companies as part of their ESG policies.

The UK tax system is arguably the most complex in the world and Burness Paull's tax lawyers comfortably chart the regime on behalf of clients.

We help minimise the tax costs and risks faced by both businesses and individuals, bringing a commercial approach to a highly technical area, and adding value for our clients by offering sensible solutions to achieving tax-efficient results.

Get in touch now to find out how we can help you with your tax needs.

Key Contacts

Karolina Rosochowska

Senior Associate

Tax & Share Incentives

Tax & Share Incentives Team Overview

The firm's tax lawyers provide tax advice across many sectors, advising UK and international companies, individuals and family businesses, local authorities and public bodies.

Working seamlessly with our market-leading corporate finance team, we deliver corporate tax advice on M&A activity, restructuring and private equity deals. Advising PE Management on management equity (grants and disposals) is particular focus.

Another area of particular expertise is around property tax, providing our real estate team with full tax support. This ranges from structural advice at the outset of the deal through to post-completion overseeing of LBTT/SDLT, with the team working across all asset classes. With particular expertise in VAT and SDLT/LBTT, the team has a unique insight into the current and emerging issues that impact real estate clients.

When it comes to tax issues affecting individuals, the firm's tax lawyers combine with our private client and corporate finance colleagues to provide a holistic service, taking into account business and personal objectives and advising them on tax-efficient ways to satisfy both. Find out more about our personal tax services here.

In addition to advising clients as their sole tax adviser, we also work in conjunction with in-house tax departments and independent tax advisers. On a corporate acquisition this encompasses working alongside a buyer’s tax due diligence provider to protect clients against tax risks.

Burness Paull's tax lawyers can help you with advice and support on:

Share Plans and Incentive

- Employee share incentives – we design bespoke incentives

- Share schemes, including EMI, CSOP and SIP

- PE Management Equity structures

- Employment Related Securities issues

Business or Property Sales

- Advice on transfer as a going concern (VAT) issues

- Options to tax land and related VAT issues

- SDLT/LBTT

- Capital allowances

SEIS, EIS, VCT

- Advice to ensure the investment meets the conditions so the expected tax relief is available

Corporate Structure

- Corporate/Group structure, especially pre-sale for tax efficient exits

- PE Management Equity

- PE portfolio company structure

- Setting up in the UK for foreign businesses

Employment Related Tax Issues

- Termination/settlement Agreements, and the tax free £30k

- IR35/ off payroll working

- Consultant vs employee tax status

Employment Related Securities and section 431 elections

Windfarms

- Tax advice on options, licences and similar

Company (Share) Sales

- Sellers

- Pre-deal stage - advice on Heads of Terms/ Letters of Intent to ensure the target’s tax assets are factored in to maximise the purchase price

- Sellers’ qualification for ER/BADR (10% CGT rate)

- Income tax risks e.g. on earn outs or due to holding ERS shares

- Liability and rights under the tax deed and tax warranties

- Buyers

- Dealing with target tax risk under a tax deed and warranties – maximise ability to recover & your process input rights

- Stamp duty – advise you on what elements of consideration are subject to stamp duty and deal with this with HMRC

Related News, Insights & Events

The Scottish Budget 2024: Our views on the tax changes

The budget did not produce many significant tax changes; however I have set out a summary of the key changes below.

Burness Paull advises management team of Horizon Energy Infrastructure and Smart Meter Assets on merger and ownership transfer

04/12/2024

Burness Paull advised Horizon Energy Infrastructure and Smart Meter Assets on their merger with Smart Metering Systems and ownership transfer to KKR.

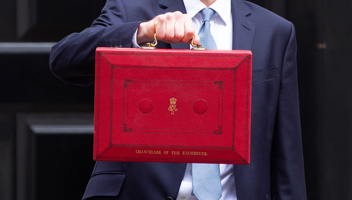

Chancellor announces biggest tax rise in over 30 years

Rachel Reeves yesterday announced the government’s long anticipated Autumn 2024 Budget.